Levy 2021

Page Navigation

Levy 2021 FAQ

-

Below is a list of frequently asked questions and answers related to the 2021 Operating Levy. Additional information will be added on a weekly basis. Please click on a question to expand the selection and view the response.

-

Why is the district in its current financial situation?

- Since 2003, per pupil funding from the State has not kept pace with inflation.

- If state funding had kept pace with inflation since 2003, Shakopee Public Schools would be receiving an additional $5.7 million in operating revenue each year.

- Lack of federal funding for important programs in services for students with special needs (Special Education) and English Learners.

- If the federal government had met its responsibilities for this funding, Shakopee Public Schools would receive an additional $9.5 million per year.

- Shakopee Public Schools is the only school district in the metro area without a voter approved operating levy

- As of present, the metro average operating levy is $1,267 per pupil.

-

How are operating funds used?

At Shakopee Public Schools, approximately 60% of operating budget is spent on teacher salary and benefits. Another 20% is

spent on other people, those providing services to our students and community. -

What were the recent budget cut amounts and what amount/percentage of past budget cuts were on administrative positions vs. teachers?

$7,450,000 in budget cuts were made prior to 2021-22 school year and details can be found here: BUDGET CUTS

- $1.7M, or 85%, of the first $2.050M in budget cuts included in the figure above did not include classroom teachers, regular assignment paraprofessionals, counselors, custodians, or health services.

- $3,999,150 of budget cuts will remain in place and are considered permanent budget cuts.

-

Aren’t there other ways to generate revenue, such as land sales, use of COVID-19 relief funds and/or use of deferred maintenance funds?

Land sales: The District cannot sell land or buildings and use the money to pay for operating expenses as it is against the law. When you sell land or buildings you can only use the proceeds to make additional capital purchases, things like land and buildings.

COVID-19 relief funds: Such funds can only be used on specific expenses as it is ‘One-time revenue.’ It helps ‘one time’, the ongoing structural deficit may be diminished for a brief period of time but it doesn’t go away. It is possible that COVID-19 relief funds, such as those from the American Rescue Plan, may lessen the pressure on general fund expenditures and by doing so enhance the district’s unassigned fund balance.

Deferred maintenance funds: Deferred maintenance funds are dedicated funds that can only be used for deferred maintenance and facilities improvements. They cannot be used for operating costs.

-

Explain the difference between a Bond and an Operating Levy?

Bond = Buildings, Levy = Learning & operations

Operating levy dollars pay for educational programs and day-to-day operations of schools, including teachers and staff support.

-

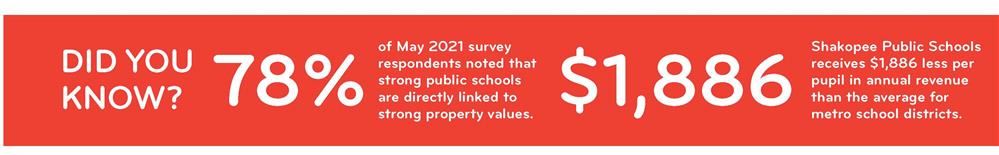

What were the results of the May 2021 phone survey conducted by a third-party?

The results from the survey and additional details can be found on the district website here.

-

What would question #1 funds go towards?

Question #1 would eliminate projected budget deficits along with restoration of some of the budget cuts that includes classroom teachers, counselors and services closest to student learning.

Restoration of some of the $5.4 million in budget cuts would include:

- Class size targets (same as 20-21 school year) $2,533,100 (34.7 teachers)

- 5th grade band-- 1.25 FTE $91,250

- 2.0 FTE EL teachers $146,000

- 2.5 FTE High Potential Teachers $182,500

- High School: 2.0 FTE Counselors $146,000

- Middle Schools: 2.0 FTE Intervention Paraprofessionals $66,000

- West: Security/Greeter position $20,000

- Elementary Schools: 3.0 FTE Intervention Teachers $201,000

- ACT student fee payments $25,000

- College in the Schools/Concurrent Enrollment Courses $40,000

TOTAL $3,450,850

NOTE: $1,949,150 of the $5.4 million in cuts remain permanent budget cuts

-

What would question #2 funds go towards?

Question #2 will request an additional $400 per pupil with a specific Yes or No question as to whether the increase in the revenue proposed by the Board be approved?

$400 per pupil generates $3,481,655 in annual operating revenue.

Funds from Question #2 would:

- Improve compensation of teachers and support staff moving towards mid-range of comparable districts

- ESTIMATED COST: At least 60% of Question 2 revenue (Minimum = $2,088,993)

- Make additional improvements to class size targets to reach metro average (ECSU)

- ESTIMATED COST: $540,000

- Increase fine arts and activities offerings

- ESTIMATED COST: $200,000

- Shorten walking distances for grades 9-12 to 1.5 miles

- ESTIMATED COST: $360,000

- Improve compensation of teachers and support staff moving towards mid-range of comparable districts

-

Do both questions need to pass?

Question #1 must pass for Question #2 to pass, should it have enough votes. Question #1 can pass independently of Question #2. In other words, if question one fails, question two automatically fails regardless of the vote count.

-

How long is a levy good for?

An operating levy is good for 10 years.

-

Where can I calculate my tax impact?

A tax calculator can be accessed here.

For agricultural property (both homestead and non-homestead), the taxes for the proposed operating levy will be based on the referendum marketing value, which is the value of the house, garage and one acre of land only. For seasonal residential recreational property (i.e. cabins), there will be no taxes paid for the proposed operating levy.

-

What did the district previously ask for on the November 2020 ballot?

The district previously asked for a phased-in levy on the November 2020 ballot, meaning the per pupil dollar amount and subsequent homeowner/business tax impact would start off lower and gradually increase. The amount was outlined as:

- $400 per pupil for taxes payable in 2021;

- An additional $300 per pupil for taxes payable in 2022 (total of $700 overall);

- An additional $200 per pupil for taxes payable in 2023 (total of $900 overall);

- An additional $100 per pupil, for taxes payable in 2024 (the total tax increase of $1,000 per pupil will continue for taxes payable in 2025 to 2030).

-

How long have the current School Board, Superintendent and Director of Finance been with the district?

- All 7 current school board members began serving after June 2018

- Superintendent Mike Redmond was hired November 1, 2018

- Finance Director Bill Menozzi was hired January 1, 2020

-

Why not move the district office services to the Central Building and save money?

Using the Central Building would entail $12 million in required deferred maintenance expenditures in future years (roof, electrical, boilers, etc.). The current cost of leased space at TownSquare is quite reasonable and cost effective as noted below. Data on current comparable spaces are noted below:

Location Type of Space Base Rent (Square Foot)

Industrial Warehouse $5.50

Town Square District Office $6.00

Industrial Office $10.00

Non Industrial Office $14.00

-

What is the admin to student ratio at the high school?

Please click on the following link to view a historical snapsho of the high school's admin to student ratio: High School Admin to Students Ratio